Zhengzhou to Doha Air Freight Price Revelation An Analysis of Turkish Airlines Flights

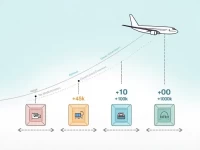

This article reveals information about the air freight route and pricing from Zhengzhou to Doha. Turkish Airlines flight TK6188 offers efficient multi-segment transport services, and a detailed analysis of costs supports smooth shipping.